WMIF MAIN SITE

2025 Event Site

Califf, who recently began his second tour as commissioner, was asked about accelerated approval for new drugs with unvalidated biomarkers based on the opinion it is “reasonably likely” a change in these biomarkers predicts a clinical benefit.

Califf said he believes accelerated approvals have a “real place” in the process and are in part a reflection of the American ethos, where individuals are willing to take on more risk for a potentially beneficial treatment. But there are also opportunities to improve the process, he noted.

“We need to assure patients and the public that the follow-up studies are going to get done so we either confirm or refute the ‘reasonably likely’ criteria. I think that’s a real lesion in the system that we need to work on.”

Watch 1:1 Fireside Chat: Robert Califf, MD, Commissioner Food and Drugs, FDA

On Tuesday, experts in emergency preparedness and infectious disease from Mass General Brigham and beyond discussed the current state of the COVID-19 pandemic. The good news is that COVID-related deaths, hospitalizations and ICU stays have all been significantly reduced, thanks to a combination of immunity from vaccinations and previous infections along with the development of new therapeutics.

The discussion also touched on the importance of global vaccine distribution. This is important not only for the sake of equity, but also to reduce the number of new viral variants that emerge and keep economy running smoothly.

“We can’t even begin to get the world economy back on track without control of disease on a global scale,” said Daniel Kuritzkes, MD, Chief of the Division of Infectious Diseases at Brigham and Women’s Hospital. “Look at what is happening in China. If China can’t have Shanghai open because of concerns around COVID, the Chinese economy can’t function, and the supply chain continues to be interrupted.”

Watch Living with COVID | Lessons Learned and Looking Ahead

What will the biotech landscape look like in New England over the next decade? That was the question tackled by a panel of experts from the fields of drug development, venture capital and innovation.

Despite some worrying economic trends, panelists agreed that New England has the potential to remain a powerhouse in the biopharmaceutical development, thanks to its deep talent pool of scientist and clinicians and a strong culture of collaboration. “New England has been and will remain to be a very potent leader in biotech and gene and cell therapy in general,” said Phillip Sharp, PhD, Institute Professor and Professor of Biology at the Koch Institute for Integrative Cancer Research at MIT and the co-founder of Alnylam Pharmaceuticals.

“There is lots of innovation in this area, and even more importantly there’s lots of collaboration,” Sharp said. “We’re fundamentally strong, we’re culturally strong, and I’m very confident that after whatever happens [with the market], there will be a very strong innovation community here in health care, biotech and pharmaceuticals.”

The recent end of a nine-year bull market in biotech may make it more challenging for new gene and cell therapy (GCT) companies to secure startup funding, the panelists said. But given the promise of these new therapies to improve patient care, they were optimistic that there will still be ways to move the best candidates forward.

“We’re incredibly creative when it comes to drug development and should be so when it comes to capital,” said Seth Ettenberg, PhD, President and CEO of BlueRock Therapeutics. “When we go through periods like this, some of the vehicles and the methods by which we go about creation will need to adapt.”

Watch The Global Biotech Epicenter: New England Now and in 2030

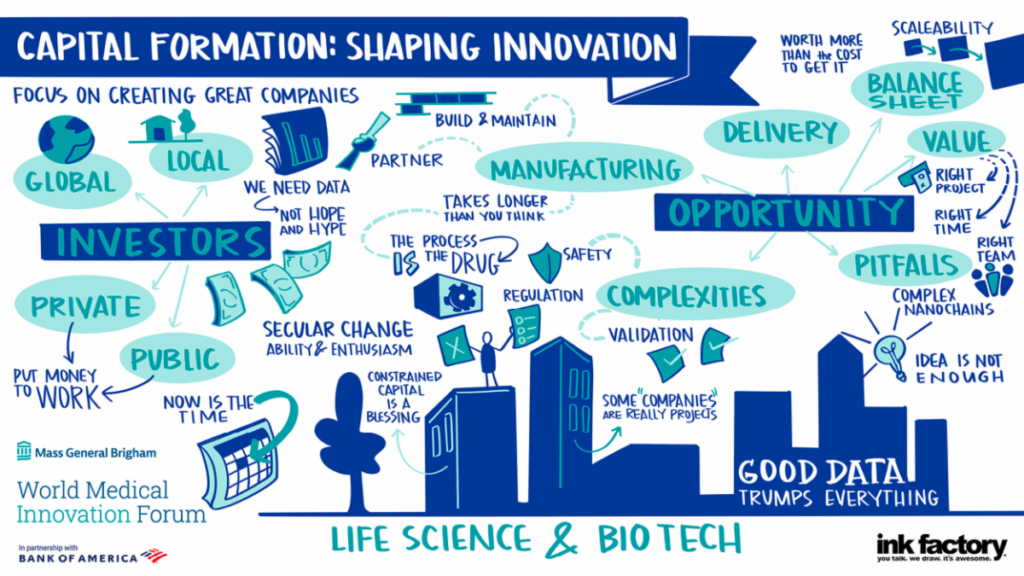

The discussion on funding continued Tuesday afternoon with a panel discussion featuring representatives from venture capital firms that are investing in GCT.

When making investments in GCT, Bain looks for companies that understand the differences from typical drug development and are prepared to navigate those uncertainties, Koppel said. This includes the challenges related to manufacturing, dose delivery and translation from lab models to human patients.

“Another thing that is pretty unique to this space is the need for the balance sheet,” Koppel added. “These are companies that are going to need a lot of capital to get to a key value-creating event, probably more so than a lot of other technologies and a lot of other areas. It’s important to us to make sure we identify situations and management teams that are raising the right amount of capital to get to those value-creating events.”

“You need that balance sheet not only for manufacturing, but also because there are going to be lots of bumps along the road,” added Stephen Knight, MD, President and Managing Partner, F-Prime Capital. “Like almost everything that is really exciting and cool—it’s going to take a lot longer than you think at any particular point in time.”

Watch Capital Formation | Shaping Innovation